Money Saving Advice from a Latchkey Kid

Where are my people? Raise your hand if you’ve ever worked in the food industry as a server? Bravo! Here’s a job that will ramp up your focus and organizational skills. Side note: If you’re willing to take a few diggers, try your hand at waiting tables and you’ll likely walk away with some A+ customer service skills. And the tips aren’t too shabby either! But don’t worry, this isn’t a recruitment ad for Texas Roadhouse (you’ll also need to take up line dancing if you want to work in this fan favorite steak joint.) Indulge me as I reminisce about my youth for a moment.

My very first job was car-hopping at Pok-A-Dots, a little mom and pop drive-in located in beautiful, Spearfish, SD. This was long before Sonic became popular but the concept was the same. As a carhop, my duties included delivering trays of food to waiting cars, making change and then cleaning up the garbage. But most importantly, my job was hoarding tips! When you’re 15 that spare change adds up like wild fire. Throughout the day, I’d collect my quarters and dimes and then exchange them for dollar bills. After work I’d stuff most of the cash into the mouth of an aluminum can. It wasn’t a piggy, but the amount inside was still a mystery. Once the can was stuffed so full that I couldn’t fit another buck inside, I’d slice it open and add up my riches. (Today we tend to frown upon using knives to slice open savings accounts, but listen, I was a latchkey kid. Our generation is widely known for its lack of parental supervision during the formative years.)

Ah, I can still remember what an awesome feeling it was to see how much money I had stashed away. And, while I don’t recall any of the fabulous “things” my money bought for me, I do have a pretty fond memory of a Van Halen concert, (circa David Lee Roth) that I’m certain my parents did not fund. So, I was clearly using my earnings to invest wisely into high-risk portfolios.

The big takeaway here is that you don’t have to be a carhop or a server to find random dollar bills in your pocket, purse or wallet. Many of us generate this loose cash at remarkable speeds and it almost never adds up to Van Halen concert tickets. The reason it doesn’t add up is because we don’t save it. We hand change over to our kids to throw into vending machines, we toss ones and fives onto the night stand with our keys and Chapstick and then elves steal them in our sleep. We forget the value of a dollar and then squawk at the price of a movie ticket. But seriously, $15 bucks…no thanks, I’ll wait and watch it on Netflix.

So, here’s the challenge!

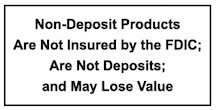

The challenge is to become more mindful of the dollar bill. And the five-dollar bill, even. Today let’s search our homes for raw material that we can fashion into money saving devices. Let’s put these devices where we’re going to see them and use them! Let’s recruit our family members to join the fun! And, let’s not forget the best part of this adventure…the mystery! Let’s define a goal and label our banks so we don’t forget what we’re aiming for. #DavidLeeRoth will do just fine. The point is that we want to stay on track and have something special to look forward to. Remember: This is our side hustle, not our Money Market Account. We’re simply reteaching ourselves some skills we’ve haphazardly misplaced over the course of time. And, when we can’t squeeze another bill into our banks, we’re going to “carefully” open our savings devices and rejoice in our accomplishments.

And who knows, maybe once you’ve cycled through this process a time or two, you set your sights on bigger goals, like becoming an accomplished venture capitalist. Hey, if your dreams don’t scare you, they’re not big enough!

Cheers to realizing your financial success!