Strength and Stability

FIRST NATIONAL BANK IS FDIC SECURED.

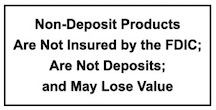

Your funds are safe, secure, and FDIC insured at First National Bank (FNB). The Federal Deposit Insurance Corporation (FDIC) covers up to $250,000 per depositor per insured financial institution. The FDIC provides separate coverage for different types of accounts, including personal accounts, joint accounts, revocable trust accounts, irrevocable trust accounts, and retirement accounts. Talk to your banker to learn how to maximize your FDIC insurance coverage.

FNB EXCEEDS REGULATORY STANDARDS.

Bank capital is the amount of money that a bank has available to absorb losses and continue operating. Banks are required to maintain a certain level of capital by regulators to ensure their safety and soundness. These capital levels are measured in the following ratios. The calculations for each of these ratios vary slightly, but all are used to determine a bank’s ability to withstand a financial downturn or other unforeseen losses. FNB has very strong capital ratios, greatly exceeding both the required minimum and those of other banks our size.

| CAPITAL MEASURES | FNB RATIO (%) | WELL-CAPITALIZED REGULATORY MINIMUMS | PEER GROUP |

|---|---|---|---|

| Tier 1 Capital Ratio | 24.04% | 8.00% | 15.80% |

| Total Capital Ratio | 25.34% | 10.00% | 16.82% |

| Tier 1 Leverage Ratio | 20.87% | 5.00% | 10.05% |

Source: www.bankregdata.com as of 12/31/22. Definitions for capital measures are below.

FNB IS HERE FOR YOU.

First National Bank is proud to be one of the strongest financial institutions in the nation and continually earns 5 Stars, the highest rating from Bauer Financial Inc., the nation’s premier bank rating firm. FNB is well-capitalized and well-positioned to weather any challenges that may arise. But first and foremost, we are here for you. We truly succeed when our customers are provided with the best banking experience possible. That is what we strive for every day, and we thank you for choosing First National Bank. Click here to find your branch’s contact information and if you ever have any questions, we are ready to help.

The tier 1 capital ratio is the ratio of a bank’s core tier 1 capital—that is, its equity capital and disclosed reserves—to its total risk-weighted assets. Total risk-based capital ratio is calculated as the sum of Tier 1 capital (as defined above) and Tier 2 capital (Tier 2 is designated as the second or supplementary layer of a bank’s capital and is composed of items such as revaluation reserves, hybrid instruments, and subordinated term debt.) divided by risk-weighted assets. The tier 1 leverage ratio is calculated by dividing tier 1 capital by a bank’s average total consolidated assets and certain off-balance sheet exposures.