Can multiple cards be linked to one registered CardValet account?

Yes, cardholders can register multiple cards within a single CardValet app. Additional cards can be added within the “Settings – Add Card” screen.

You can download the card on multiple devices but are requested to indicate which device is “primary.”

Does CardValet work for FNB ATM cards?

No, CardValet only supports your FNB debit cards.

How quickly does the on/off status or other restriction(s) take effect?

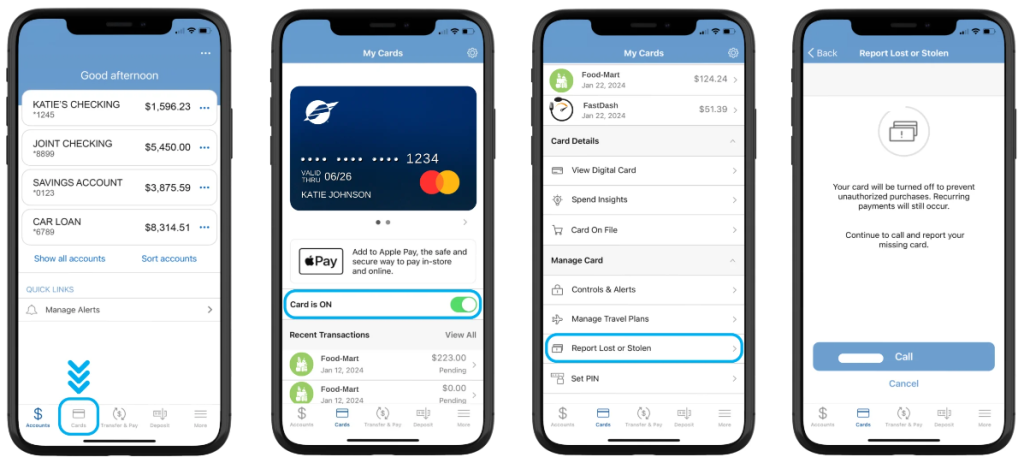

Transaction restrictions and alerts are active immediately once set. When you turn your card off, the change is instant, and all transactions will be declined until you turn the card on again. This is especially helpful in cases where your card was lost but then you find it later.

A threshold limit of $50 has been set, but the card user is declined at some gas stations. Why?

Some merchants pre-authorize the card for an amount larger than the actual transaction amount. In this instance, the pre-authorization amount must meet the threshold spend limit.

What types of transactions display in CardValet?

CardValet only shows the transactions that are performed with the card. It does not show non-debit card transactions that are done on the account, such as teller transactions or bill pay on an account.

If I turn my FNB debit card off using Card Valet, will my recurring transactions be blocked?

No. Any automatic, recurring debit card transactions – such as gym membership subscriptions, and bill payments – will continue to be processed even when your card is turned off.

When I receive a reissued or replacement card, will I need to update my cards within the CardValet application?

Yes. If the card number is new, then you must “add” the new card number to your profile. In addition, you may delete the old card by accessing Settings > Manage Portfolio.